While there were record crowds and spectacular flying displays at the recently concluded Dubai Airshow, there were fewer commercial aircraft orders in 2019 compared with previous events, writes Denise McNabb from Al Maktoum International Airport.

The five-day, biennial Dubai Airshow lived up to the United Arab Emirates’ (UAE) reputation as a host for eye-popping events.

It attracted record crowds and exhibitors but deals inked were less than half those of the 2017 air show, reflecting a recent slowdown in the aviation and aerospace industry as well as aircraft orders still in the pipeline.

The US$54.5 billion ($A80.25 billion) tallied by organisers for sales made at the event was less than half the US$114 billion in 2017.

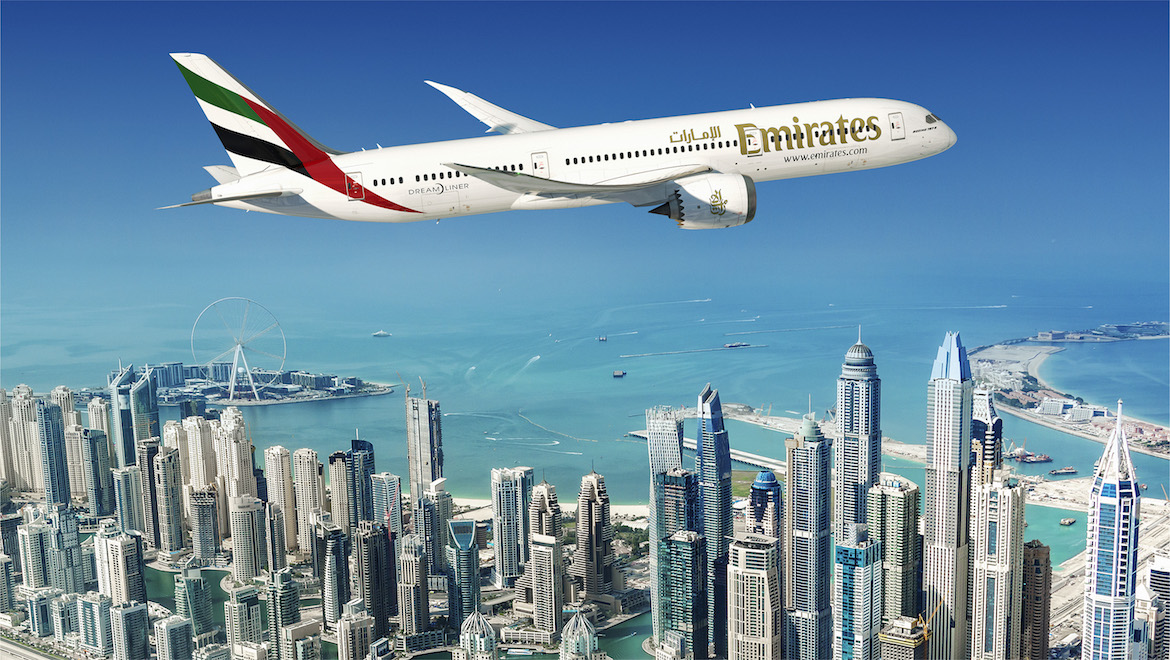

Of that amount, the largest chunk involved hometown carrier Emirates Airline, which involved aircraft substitutions to its existing orders with Airbus and Boeing.

Emirates reduced the number of planes it had announced it would buy at previous airshows and revised some aircraft sizes, shaving billions off forward orders.

It was Sharjah-based low-cost carrier (LCC) Air Arabia that claimed the title of making the biggest new order, signing up for a mix of 120 Airbus A320neo and A321XLR aircraft worth US$14 billion at list prices.

The carrier with a fleet of 53 Airbus aircraft, recently signed a joint venture with Abu Dhabi’s Etihad to launch Air Arabia Abu Dhabi.

The airshow, opened by Dubai’s ruler Sheikh Mohammed bin Rashid Al Maktoum, and Crown Prince of Abu Dhabi Sheikh Mohammed bin Zayed Al Nahyan at Al Maktoum Airport (Dubai World Central), south of the city, attracted around 1288 exhibitors, a static display of 161 aircraft and 84,043 trade attendees. It was also enhanced by three days of aerial and acrobatic demonstration by large commercial aircraft, fighter jets and helicopters.

The 2019 #DubaiAirshow is underway at Al Maktoum International Airport. The opening day featured an #Emirates #Airbus A380 flying at 1,000ft, as well as seven Aermacchi MB339A jets from the United Arab Emirates Air Force Al Fursan aerobatics demonstration team #aviation pic.twitter.com/oI9hcRpPPt

— World of Aviation (@the_wofa) November 18, 2019

Unavoidably, the grounding of Boeing 737 MAX aircraft in March after the Ethiopian Airlines and Lion Air crashes, killing all 346 on board, was a frequent conversation point.

Ethiopian Airlines chief executive Tewolde Gebremariam was at the air show to sign a deal with Boeing for the retrofitting of its 787 fleet with interactivity.

He told reporters the airline was still deciding whether or not it would add more 737 MAX aircraft to its fleet but assured the relationship it had with Boeing was good.

Kazakhstan flag carrier Air Astana signed a letter of intent to buy 30 737 MAX 8s for its new low-cost airline FlyArystan.

Air Astana chief executive Peter Foster said the airline had a strong relationship with Boeing since it had started flying in 2002 with two 737NGs.

“Today we operate both 757s and 767s and we believe that the MAX will provide a solid platform for the growth of FlyArystan throughout our region, once the aircraft has successfully returned to service,” Foster said.

Turkish and German leisure airline Sun Express converted an option for 10 737 MAX 8s to a firm order, adding to the 32 MAX aircraft it has in its fleet.

An unidentified buyer also ordered 10 737 MAX 7 aircraft and 10 737 MAX 10. The first MAX-10 was rolled out of the Boeing workshop at Renton, Washington on November 22.

The Dubai government-owned LCC flydubai attended the event but did not exhibit its aircraft as part of efforts to minimise disruption to passengers given its 14 737 MAX 8s remain grounded while Boeing works to secure regulator approval for the type to return to service.

Emirates revision

Emirates came into the Dubai Airshow as the world’s largest customer for the 777-X family of aircraft by some margin with 150 on order that was made in 2011. The next largest was Qatar Airways with 60.

And while the Dubai-headquartered carrier retained its position at the top of the table at the end of the event, the gap was reduced by 24 aircraft after Emirates opted to substitute a number of 777-9Xs on order with 787-9s.

Under the new deal announced on November 20, Emirates said it would exercise substitution rights to swap 30 777-9Xs for 30 787-9s. The order spelt the end of the 2017 airshow memorandum of understanding (MOU) Emirates made for 40 787-10s.

The engine choice for the 787-9 was yet to be decided.

The airline also swapped firm orders for six 777-300ERs to the 777-X family of aircraft, which brought the total order for the 777-X to 126 airframes.

Deliveries of the 787-9 would begin in 2023 and run over the the following five years.

However, the timing of 777-9X deliveries was up in the air given recently announced delays to the aircraft’s development due to engine issues.

Emirates president Sir Tim Clark said the uncertainty of the delivery timetable of the 777-X family of aircraft had affected the airline’s fleet and network plans.

“Our main focus at the moment is getting the [777]X out of the door,” he said, noting Boeing’s latest timeline review for the launch was the second quarter of calendar 2021.

“We were due to get it in June of next year. Now we don’t know when we are going to get it.

“We were very much involved in the design of that aeroplane and getting them to build it for us so we wait and see as to when it happens, what it will do and when they can get it to us.

“We’ve got a route network to serve and if you can’t give us the aeroplane in the time we want, we’ll have to get other aeroplanes. That’s the brutality of the model. We can’t slow things, stop things because those aren’t coming on.”

Boeing has said previously it expected first flight of the 777-9X to occur in early 2020, with first delivery to occur in 2021.

Sir Tim said he met with the head of US Federal Aviation Administration (FAA) Steve Dickson during the airshow to discuss the certification process for the 777-X as a derivative rather than an all-new design.

He told Reuters after the meeting that he was “very much reassured” by what he has been told. He also said that as the largest customer of the aircraft he wanted the plane to be put through “hell on earth” in testing to ensure it was safe to fly and met performance expectations.

Emirates chairman Sheik Ahmed bin Saeed Al Maktoum said the Dreamliner order provided the airline “with the agility, flexibility and spread of seat segments when it comes to overall seat capacity to serve a range of destinations as we develop and grow our global network”.

Airbus orders

On the Airbus, Al Maktoum said Emirates had firmed up orders for 50 Airbus A350-900s aircraft, powered by Rolls-Royce Trent XWB engines.

The 50 aircraft replaced a cancelled order in February of 39 A380s, which proved to be the catalyst for Airbus’s decision to end the A380 production in 2021.

The order for the A350s, also replaced a February heads-of-agreement Emirates made with Airbus to buy 30 A350 aircraft and 40 A330neos.

The first A350 would be delivered in 2023 and was expected to include premium economy seats – a first for Emirates.

Al Maktoum said the A350-900 would provide the flexibility for short and medium trips or long haul.

Further, Sir Tim noted the A350-900 also had the long-range capabilities to fly from Dubai to Adelaide, the east coast of Australia or the west coast of the United States.

However, it might not be big enough to serve those markets.

“The only problem is with the kind of seat configuration it may be a little bit too small for Australia and certainly for the west coast,” Sir Tim said.

Forbes magazine calculated the reduced Emirates aircraft orders announced at the air show sliced US$20 billion off its previous Boeing and Airbus orders, at list prices.

Other deals

Overall, Airbus received 220 aircraft orders at the airshow, while Boeing received 97, including small orders for Dreamliners from Binman Bangladesh Airlines, Egypt Air and Ghana Airlines.

Other sales announced during the event included three De Havilland Canada Dash 8-400 turboprops by Elin Group of Nigeria

Nigerian carrier Air Peace bought three Embraer 195-E2s, Egyptian lessor CIAF, three E190s and Omani low-cost carrier, SalamAir signed a lease for two Airbus A321neos from GECAS.

The world’s first eco-friendly air-racer monoplane was also displayed by Air Race E at the show ahead of an electric racing series, expected to be launched in late 2020 with support from Airbus.

Sensitive arms deals and defence contracts were also signed on the show’s sidelines but announcements were largely kept under the radar.