Before the surprise 200-aircraft Boeing 737 MAX order hit towards the end of Day 2 of the Paris Air Show, the orders were something of a grab-bag headlined by a three-figure deal for ATR turboprops, writes John Walton from Le Bourget.

Lessor Nordic Air Capital orders 105 ATRs

ATR, the Airbus-Leonardo joint venture, secured a massive order for 105 of its latest-generation turboprops from lessor Nordic Air Capital (NAC), which specialises in regional aircraft, at the Paris Air Show on Tuesday (European time).

Under the letter of intent (LOI), the 105 aircraft comprised 35 firm orders, 35 options and a further 35 purchase rights. The initial 35 aircraft were scheduled to be delivered between 2020 and 2025.

“The deal represents a seal of long-term confidence from the number one regional aircraft lessor whose desire to focus on the most efficient and sustainable technology has led them to invest in the ATR 72-600,” ATR said in a statement.

“NAC’s recognition of the quality of the ATR programme also highlights the enduring retained asset value of the -600 series and its value proposition in the market.”

ATR chief executive Stefano Bortoli said the deal was “very much in line with the trends in regional aviation to connect communities and develop businesses across the globe in the most responsible and cost efficient way”.

“To receive this order from the leading lessor in our segment, validates the value creation and quality of our product and its sustainable credentials and shows the efficiency of turboprop technology going forward. This deal clearly shows where the trend in regional aircraft is going.”

Regional Aviation Specialists @nac_dk signed for over 100 ATR-600s! #ParisAirShow #PAS19 #ATR72 #ATR42 #ATRintolife #Avgeeks pic.twitter.com/M5kjKEtDc1

— ATR (@ATRaircraft) June 18, 2019

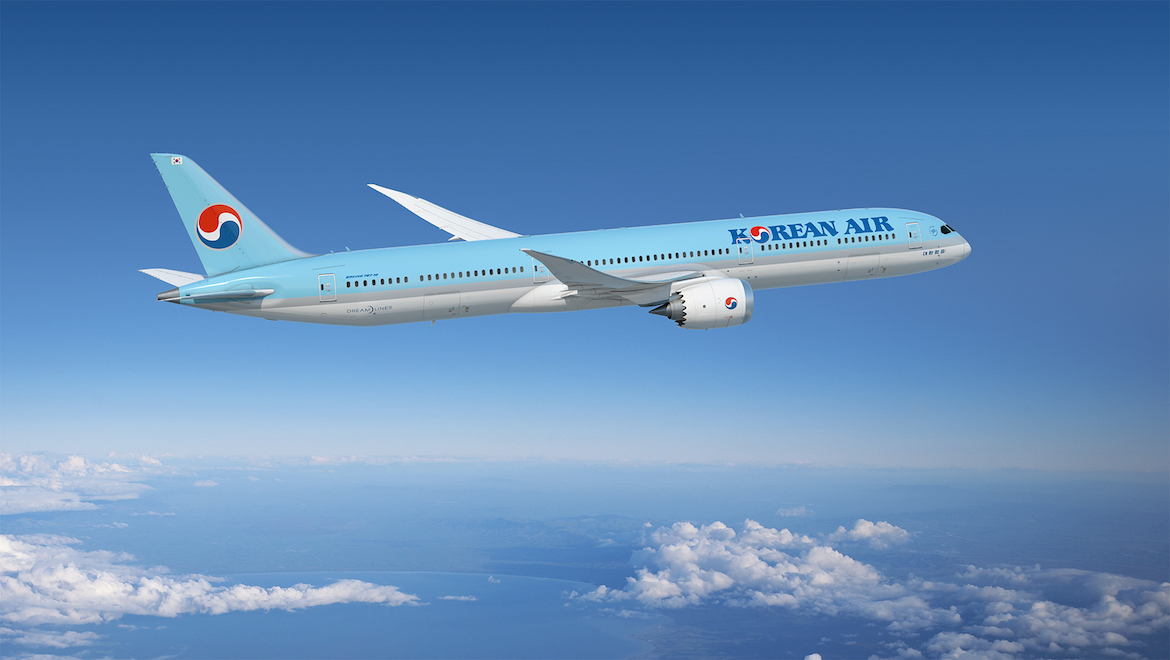

Boeing scores 30 more 787s for Korean Air and five for Air Lease Corp

Korean Air has signed a memorandum of understanding (MOU) with Boeing for 20 additional Boeing 787 aircraft, as well as announced a deal with Air Lease Corporation (ALC) for a further 10 Dreamliners.

The airline said it planned to purchase 10 more 787-9s (to add the the existing 10 it already has) and add 20 787-10s to its Dreamliner fleet, with 10 ordered directly from Boeing and 10 via lease.

“As we continue to innovate our product offering, the 787 Dreamliner family will become the backbone of our long-haul fleet for many years to come,” Korean Air chief executive Walter Cho said in a statement.

“In addition to 25 per cent improved fuel efficiency, the stretched 787-10 offers around 15 per cent more space for passengers and cargo than our 787-9s, which will be critical to our long-term business goals.”

Air Lease chief executive John Plueger said the company was pleased to bring the 787-10 to Korean Air in a joint effort with Boeing.

“The 787-10 provides significant revenue enhancement to complement Korean’s 787-9 fleet, and the long-term lease of ten 787-10s from ALC will greatly expand the scope and reach of the 787-10 in Korean Air’s global network.”

Korean will continue with General Electric’s GEnx engine on the new Dreamliners.

Separately, ALC said it has ordered five more 787-9 that were required by its airline customers to satisfy strong lease placements for the type. The company noted demand for reliable, versatile and fuel-efficient aircraft was at an all-time high.

Embraer tops up two orders for two E-Jets each

The Brazilian airframer soon to be known as Boeing Brasil-Commercial notched up a grand total of four additions to existing customers’ fleets on Tuesday.

Japanese niche carrier Fuji Dream Airlines, which exclusively operates the passenger-friendly Embraers regional jets, said it would take two more E175s. It currently had 14 E-jets, comprising three E170s and 11 E175s.

“These new aircraft will give us the ability to grow our capacity, allowing us to add more routes and frequencies, while also offering our passengers the best cabin in its category,” Fuji Dream Airlines chief executive Yohei Suzuki said in a statement.

#NEWS | #Embraer announced at the @salondubourget two #E175 for @FDA_fujidream. Learn more: https://t.co/kJdi1iLqgf #PAS19 #Embraer50 #EmbraerStories pic.twitter.com/sCl5nWN0kl

— Embraer (@embraer) June 18, 2019

Meanwhile, Spanish airline Binter, also known as Binter Canarias given its base on the Canary Islands off the coast of northwestern Africa, announced it would exercise two purchase rights for E195-E2s, in addition to the three it ordered last November.

“We are extremely proud that Binter is reinforcing its commitment to the E2 program and has confirmed these new acquisitions even before the first E195-E2 delivery to the airline,” said Embraer vice president for Europe, Russia and Central Asia Martyn Holmes.

#NEWS | #Embraer announced at the @salondubourget a firm order with @BinterCanarias for two additional #E195E2.Learn more: https://t.co/kJdi1iLqgf #PAS19 #Embraer50 #EmbraerStories pic.twitter.com/T0uD4LEW5e

— Embraer (@embraer) June 18, 2019

AirAsia converts all 253 A320neos to A321neos

Lock stock and smoking re-engined narrowbody! AirAsia has announced it would convert its entire future A320neo fleet to the larger A321neo family.

Airbus said AirAsia would become the world’s largest customer for the A321neo.

“The change will enable the airline to offer higher capacity in response to ongoing strong demand across its network,” Airbus said.

“In total, AirAsia has placed orders for 592 A320 Family aircraft. Following the upsizing, AirAsia’s backlog with Airbus includes 353 A321neo. To date, the airline has taken delivery of 224 A320 Family aircraft.”

AirAsia Group executive chairman Datuk Kamarudin Meranun said the order followed a number of years reviewing what the future of its operations would be.

“With its numerous efficiency benefits and the operational flexibility this aircraft brings, the A321neo will be the new backbone of our operations as we continue to expand to meet growing air travel demand across Asia,” Meranun said.

Airbus wrapup: Saudia and Atlantic A320neo, Delta A220, new max-pax for Cebu

Cebu Pacific (CEB) of the Philippines ordered 31 aircraft from Airbus’ neo generation, comprising 16 A330-900neos, 10 A321XLRs and 5 A320neos.

The low-cost carrier (LCC) will operate these aircraft in an all-economy maximum passenger configuration, focussing on the low-cost end of the Philippines market.

It is both the first customer for the maximum passenger 194-seat A320neo and has also worked with Airbus to boost the capacity of the A330-900neo to a truly astounding 460 passengers, up from 437 on its similarly-sized A330-300, which had a max-pax limit of 440.

The change? It’s all about rejigging the lavatory layout — some Airbus magic, it seems — to fit in 20 extra ultra-narrow seats in the 3-3-3 leisure/LCC configuration that is already flying to Australia and around Asia.

“The A330neo will give us the lowest cost per seat and allow us to continue offering the lowest fares,” Cebu Pacific chief executive Lance Gokongwei said in a statement.

“Moreover, the lower fuel burn matched with higher seat density will allow CEB to address growing demand for leisure and business travel, by upgrading aircraft and maximising available airport slots in Manila and other megacities we serve.”

Deliveries would begin in 2021 and run until 2026. Cebu Pacific said it expected to have an all-neo fleet by 2024 as older Airbus aircraft would be retired as the new aircraft arrived.

Meanwhile, in a slightly complicated and unclear statement without a corresponding press conference, Airbus announced Saudi Arabian Airlines (Saudi) had “decided to expand its existing A320neo Family order from 35 to as many as 100 NEO aircraft including 35 options. The additional firm order took Saudia’s order of A320neo Family aircraft to 65 of which 15 are A321XLRs.”

Australian Aviation was seeking further clarity from Airbus about precisely what part of this order was new, if any of it represented conversions from older A320neo orders, and what the split between firm orders and the various types of options was.

Elsewhere, the Faroe Islands’ flag carrier Atlantic Airways, which already operates three Airbus A320s, said it would add two A320neo aircraft to its fleet “to further develop its European network”. Atlantic will decide later on engine type.

Finally, US carrier Delta Air Lines, meanwhile, added a further five A220-100 jets to its order book. It had previously ordered 40 of the smaller version of the aircraft formerly known as the Bombardier CSeries, as well as 50 of the larger A220-300 version.

And finally . . .

Cebu Airbus #A330neo, #A320neo and #A321neo order and some new/launch #maxpax numbers: more on this later, but it’s crucial not to impose a Western #PaxEx lens on this airline. It creates fares that mean people can go home to visit family or travel for the first time. #PAS19 pic.twitter.com/8qARNw67ug

— John Walton ?️??? (@thatjohn) June 18, 2019

John Walton is at Le Bourget all week — follow him live on Twitter at @thatjohn.