Air New Zealand says it will defer aircraft deliveries, slow capacity growth and undertake a cost-cutting exercise in response to softer market conditions.

The airline said on Thursday the initiatives were the outcome of the review of its network, fleet and cost base that commenced earlier in 2018.

“The actions we are announcing today are focused on re-aligning our business to ensure a return to earnings growth in the lower growth environment,” Air New Zealand chief executive Christopher Luxon said in a statement.

“Air New Zealand is experienced at adapting to changing macro environments, and the actions outlined in the business review today will ensure the business is more dynamic, increasingly competitive and financially resilient for the future.”

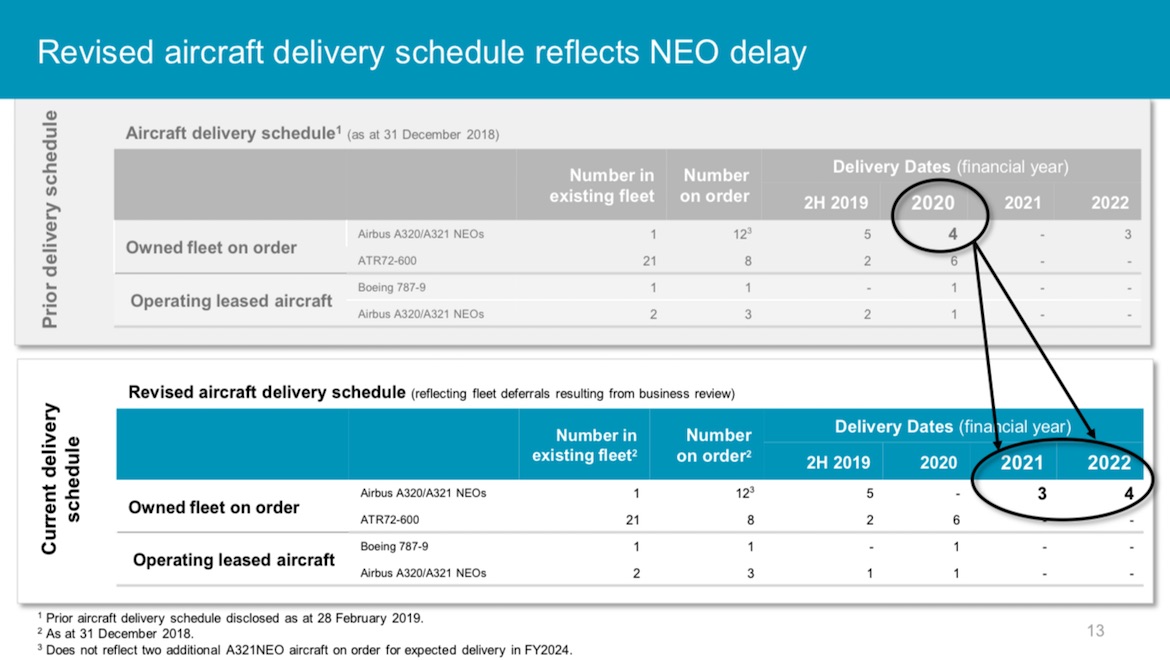

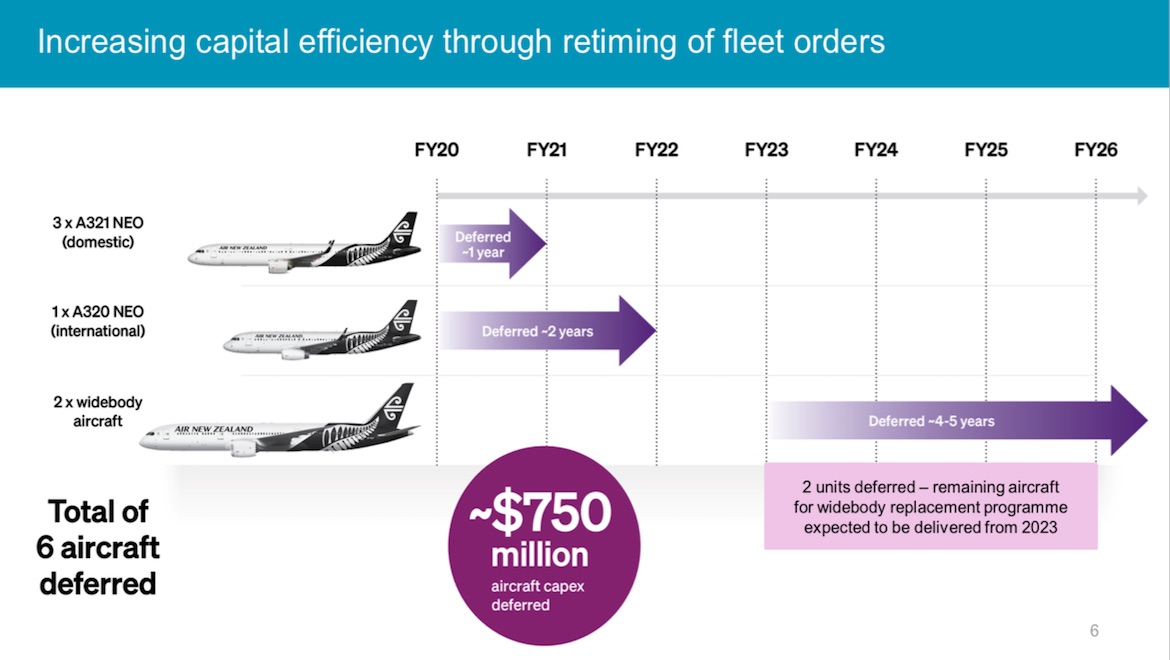

In terms of narrowbody aircraft, Air New Zealand said it would push back by 12 months the delivery of three Airbus A321neos slated for its domestic network and delay by two years the delivery of one A320neo for the airline’s trans-Tasman services.

According a slide presentation to the financial community published on Thursday, Air New Zealand was now expected to take one leased A320neo family aircraft between now and the end of the 2018/19 financial year, and one leased A320neo family aircraft in 2019/20.

This would be followed by three purchased A320neo family aircraft in 2020/21 and four purchased A320neo family aircraft the following financial year.

Meanwhile, Air New Zealand has extended the timing of its replacement program of eight Boeing 777-200ERs.

The 777-200ERs, which are mainly used on long-haul services to the Americas and Asia, as well as select trans-Tasman routes, were delivered between 2006 and 2007, making them between 12 and 13 years of age.

The airline has said previously it expected to announce an order for new widebody aircraft to replace the 777-200ERs by June 30 2019 for delivery during the 2022/23 financial year.

Under consideration are the Boeing 777-X, 787 family of aircraft and the Airbus A350 platform.

While the choice of replacement aircraft is yet to be revealed publicly, Air New Zealand said on Thursday it would defer the delivery of two units for between four and five years. The first aircraft was still expected to be delivered from 2023.

The fleet decisions would defer NZ$750 million in aircraft capital expenditure.

“The new delivery schedule reflects changes made to the airline’s network to improve its profitability and will better support a lower rate of growth for the coming years,” Air New Zealand said.

“The airline also maintains flexibility to adjust its fleet orders in the future should demand levels increase.”

Air New Zealand has revised downwards its forecast for network capacity growth over the next three years to between three and five per cent, on average, compared with five to serve per cent previously.

Air New Zealand targets NZ$60 million in annual cost savings

In response to the “current lower revenue growth environment” Air New Zealand said it would embark on a new two-year cost reduction program that aims to achieve NZ$60 million in additional savings on an annualised basis.

The target would be achieved by taking out costs associated with a reduction in overheads of about five per cent through “reprioritisation of spend, process efficiencies and automation” and a targeted review of the operations cost base, Air New Zealand said.

There will also be savings from “removal of inefficiencies” incurred as a result of disruptions to the airline’s Boeing 787-9 operations due to the durability issues experienced on the aircraft’s Rolls-Royce engines, which led to the wet leasing of extra aircraft as cover and retiming of some long-haul flights.

The two-year program was in addition to ongoing cost saving initiatives of more than $50 million per year.

Air New Zealand reported a 35.4 fall in net profit for the first half of 2018/19.

On Thursday, it reaffirmed previous earnings guidance for earnings before taxation is expected to be in the range of NZ$340 million to MZ$400 million for the full 2018/19 financial year.

This compared with earnings before taxation of NZ$540 million in 2017/18.

Air New Zealand chairman Tony Carter said the board supported the recommendations of the review and the management team’s ability to deliver stronger results for the airline’s staff, customers and shareholders.

“Both management and the board have proven their ability to re-position the airline for success across different external environments, and this time is no different,” Carter said in a statement.

Luxon says growth opportunities still out there

Despite the lower growth environment, Luxon said there was still strong potential to grow revenue and profitability by tapping into new markets and lifting the performance of some markets that were “not meeting their potential”.

To that end, Air New Zealand is adding a new nonstop flight between Auckland and Seoul Incheon from November 23 2019 with 787-9s. The service will operate three times a week when it kicks off and will be increased to five times a week during the peak end-of-year holiday period.

There are also frequency increases on existing routes, with Auckland-Taipei be served five times weekly during peak periods, compared with three times a week currently.

Air New Zealand’s Auckland-Chicago service will also receive a seasonal increase to five flights a week over the Southern Hemisphere summer holidays, compared with three times a week at other times.

And the airline said it was retiming its Auckland-Hong Kong service from October 2019 to free up one widebody aircraft.

“We continue to see exciting growth opportunities that enhance our Pacific Rim strategy, including entering new markets such as Seoul,” Luxon said.

“Our number one priority is optimising our network mix to maximise profitable growth.”

There was also ongoing investment in the passenger experience, with an updated business class seat to be installed on the airline’s existing widebody fleet from the end of calendar 2019 and a “more spacious economy cabin product” for long-haul aircraft slated for mid-2020.

The airline is also spending $50 million to upgrade nine premium passenger lounges over the next two years.

David

says:“in response to softer market conditions”

Forward bookings are just aweful. Worst since GFC.

Barry

says:Having recently completed AKL to SFO & Chicago to AKL long hauls with Air Nz in economy as well as trans Tasman flights a couple of thoughts spring to mind.

1. Get rid of the 10 abreast in economy on the 777, whoever signed off on this configuration should be made to sit in one of the middle seats at the rear of the plane & fly every sector that these planes fly & then logically justify his decision.

2. Catering on board, look at some other airlines for inspiration. Or alternatively get the person mentioned in #1 above to eat the meals. 2 examples I struck, Pasta with Bolognaise served at a tepid temperature ( that’s being generous). Omelette for breakfast consisted of eggs & nothing else. Incredibly bland.

The crew on board were generally friendly and helpful but one wonders how much the current management listen to them or even support them?

Chris

says:The B777 was designed for 10 abreast (3-4-3) seating configuration and almost all B777 operators are now using the 10 abreast configuration.

kerry

says:well done AIR NZ – nimble, agile, getting ahead with mix of saving / efficiency initiatives as well a string focus on growth and new product

Qantas take note – we have been caught out previously!!!!

Red Cee

says:Barry, as far as I am aware, all airlines that operate the 777 have ten abreast in economy. An all airlines I have flown on the 777 are cramped. The reason I now avoid the 777 altogether.

Geoff

says:The words best, Singapore Airlines, operate the 777 in 9 abreast as per the design of the aircraft. This arrangement is very comfortable. The rest are not the best.

The best in Japan, ANA, operate the 787 in 8 abreast, again as per original design.