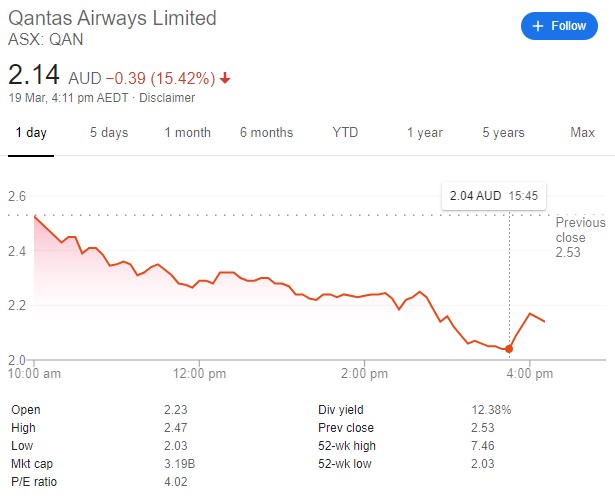

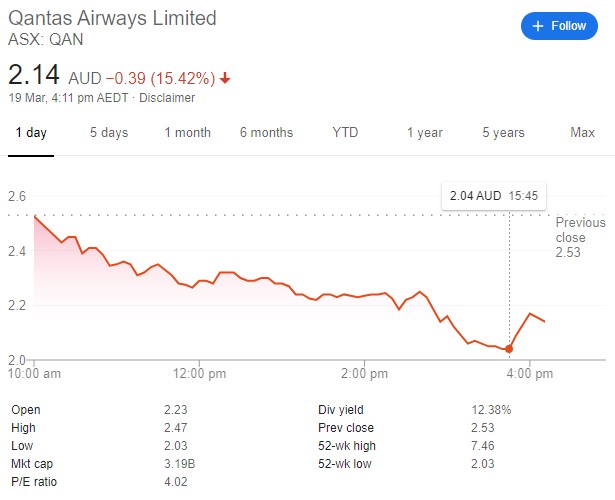

Qantas Group shares came perilously close to dropping below $2 on the day the airline announced it was suspending two-thirds of its staff.

Shares plummeted from $2.53 on Wednesday to a low of $2.03 before making a partial recovery to close out the day on $2.14. In December, stocks in Qantas were selling for $7.46.

Virgin Australia had a difficult day itself, with shares closing down 12 per cent to just $0.059.

Earlier in the day, Qantas Group dramatically said it was cancelling all international flights from late March and “standing down” 20,000 employees.

Chief executive Alan Joyce said, “The efforts to contain the spread of coronavirus have led to a huge drop in travel demand, the likes of which we have never seen before. This is having a devastating impact on all airlines.

“We’re in a strong financial position right now, but our wages bill is more than $4 billion a year. With the huge drop in revenue we’re facing, we have to make difficult decisions to guarantee the future of the national carrier.”

The airline group said flights will continue until late March to assist with “repatriation” and will then be suspended until at least the end of May 2020.

More than 150 aircraft will be temporarily grounded, including all of Qantas’ Airbus A380s, Boeing 747s and 787-9s, and Jetstar’s Boeing 787-8s.

The airline is currently in discussions with airports about parking the aircraft. Domestic, regional and freight connections will be maintained “as much as possible”, with some passenger planes used for freight, too.

The Transport Workers Union slammed the decision to ask suspended staff to take leave, saying they were effectively bailing out the airline.

Michael Kaine, the TWU’s national secretary, said, “This plan is designed to wipe the slate clean on all worker entitlements, including long-service leave and accrued benefits.”

Craigy

says:With everything that is going on, you have to wonder what planet these union officials live on. But hey they are ok as long the union members continue to pay their dues so the union staff and leadership still gets paid.

Daniel Narayanan

says:Kindly acknowledge. Thanks

Richard

says:Hard to pick the bottom here, got to buy moments before Virgin collapses.

Timing is everything.

Bernard Samms

says:I think the dividend payout currently delayed should be abandoned. Over $200 million could then be added to the government assistance money not to shareholders wallets.

Lee McCurtayne

says:Well the time is rapidly approaching for government, at least nationalising Qantas for a period that would be mutually acceptable.

Grant Mitchell Spork

says:Only recently Alan Joyce was remunerated $AUD 25 million in one year. An unconscionable level for a CEO. The reasin for such avarice? Because corporate Australia would have difficuly getting talented candidates without this bonus structure. I hardly think so. The public are beyond angry with the board, now the begging bowl is out. No public money should be provided to Virgin or Qantas unless they are declared insolvent. The CEO and biard should be replaced. Many are choosing to fly alternative airlines to Qantas, 30,000 lay offs! If in trouble the carriers should be nationalised with a severe dilution of current capital. CEO to go!